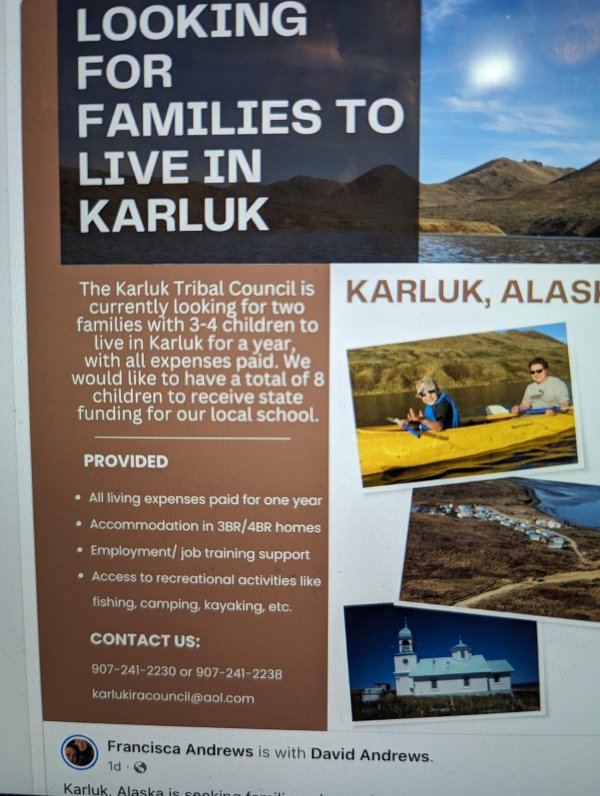

A way to shake things up and start over?

What about it?

We are not in a position to take this but do these types of opportunities give people a chance to reset?

If you have children and are struggling has anyone ever done a big move like this and it's worked? I thought of this as someone posted earlier about leaving the US and seeking asylum as a way to start over

I relished the challenges of disrupting an entire industry and trying to delight customers to a degree that had never been achieved before

What about it?

„When I think back to why raising the money to help grow the business was one of the best moments of my life, I realize it’s because the journey was far more exciting than getting to the finish line. I relished the challenges of disrupting an entire industry and trying to delight customers to a degree that had never been achieved before. The excitement I felt from putting together a world-class team of employees and investors, succeeding against all odds, and building a multibillion-dollar retail leader from nothing was unequivocally the greatest of my career.“

Trust the process.

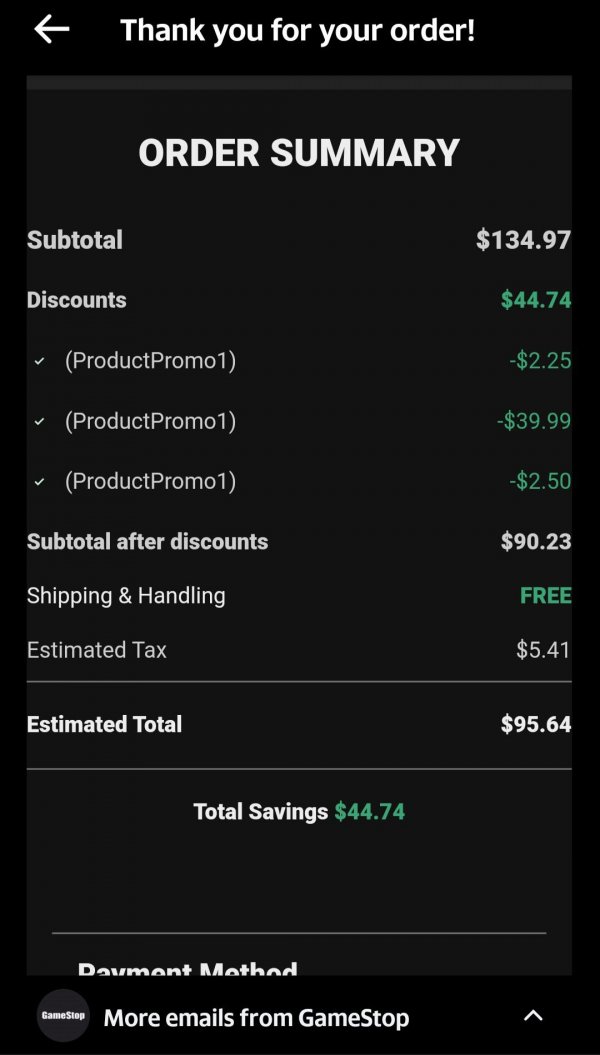

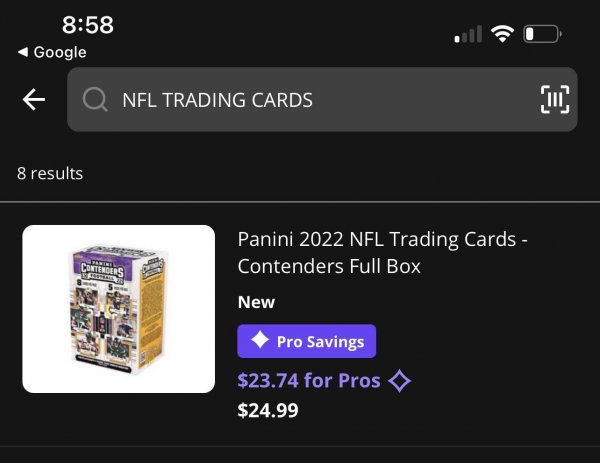

Sports Trading Cards at GameStop - Question

What about it?

Hey y’all - I’m a big sports card collector and my local GameStop had NFL and MLB trading cards a few weeks ago and store manager said it’s first time they had them in. Panini, one of the main trading card brands shipped out the second half of 2022 cards and I want to reach out to GameStop to see if they will have any, and more importantly, see if I can make a request for them to add it to their list of products. Who can I reach out to or tweet to try to get it on their radar?

Why is this important? The trading cars hobby really exploded in 2020 and continues to go wild. I went to 7 Walmarts this morning and they are all out of stock already. Trading card boxes are anywhere from $25-$60 on avg.

Since they already have the product on a small scale, it’s already sourced from procurement/supply chain, so might be easy for them to add more.

Thoughts?

**Justin Fields to the moon

Who is gonna tell them that it’s all a façade? Every retirement fund should be suing Kenny, Jaime, Fink and Cifu before they socialize all of the loses!

What about it?

Set-it-and-forget-it funds millions of Americans use to save for retirement at work are increasingly at the center of federal lawsuits alleging underperformance, posing new risks for employer sponsors who rely on them.

Target-date funds automatically reshuffle investments over a period of decades to maximize returns as retirement approaches, but workers at major companies are accusing their employers of failing to prudently monitor them over short, three-to-five-year windows.

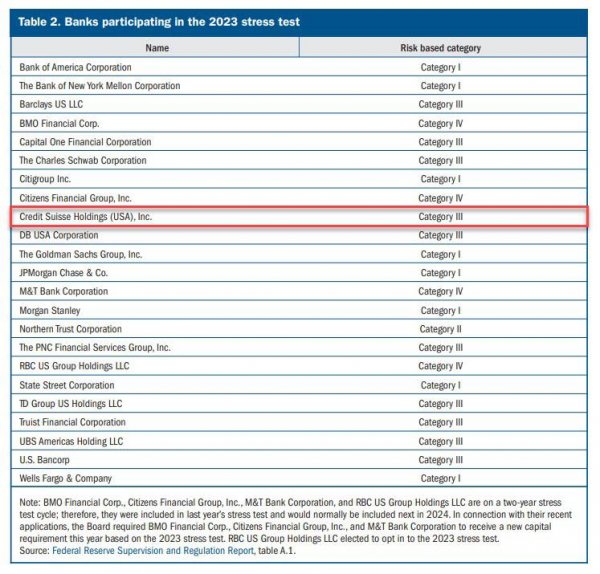

JPMorgan Chase & Co.‘s SmartRetirement Funds are implicated in the latest phase of litigation brought by participants in an Intermountain Healthcare Inc. subsidary’s plan earlier this month. Nearly a dozen companies were sued last year for allegedly sacrificing returns by chasing low fees offered in BlackRock Inc.‘s suite of LifePath index Funds.

Employers rely heavily on relatively inexpensive and easy-to-use TDFs to fill out their 401(k) and 403(b) plan menus. They account for nearly a third of total US retirement savings and are found in nearly 98% of defined-contribution plans, according to The Vanguard Group Inc. Entangling such a ubiquitous investment option in workplace retirement plan litigation could have far-reaching effects, shifting employers’ focus from fees to returns.

“Fees litigation has encouraged employers to flock to the safety offered by TDFs,†said Daniel Aronowitz, managing principal and owner of Euclid Fiduciary Managers LLC. “Now the future seems to be less about fees and more about performance, throwing all of this on its head.â€

Plaintiffs in the Intermountain Healthcare suit contend that their employer, Sisters of Charity of Leavenworth Health System, mismanaged the group retirement plan by keeping an actively managed JPMorgan TDF suite on the investment menu, despite allegedly poor performance against industry-accepted benchmarks.

Similar lawsuits filed last year against Citigroup Inc., Marsh & McLennan Cos. Inc., and Cisco Systems Inc. argue that low-cost BlackRock funds had been outstripped by competitors over the past three to five years.

“The issue that’s unfair in these cases is the central question: When have you underperformed?†Aronowitz said. “What is the amount of time that would be prudent to change these funds? We’ve always thought of these as long-term investments, so why are a few years of performance so critically important?â€

Advance Publications Inc.-owned Condé Nast was able to beat back its TDF lawsuit in June, the fourth of the 11 total BlackRock-related lawsuits that wasn’t able to survive the motion to dismiss phase, including Booz Allen Hamilton Holding Corp., Capital One Financial Corp., and Microsoft Corp.

It’s enough to “give plaintiffs pause,†but the select few firms bringing TDF suits against companies are bound to “regroup and try again,†said Gary Blachman, an Ice Miller Strategies Inc. partner. The potential rewards for TDF settlements are major, so firms are finding TDFs that have underperformed their peers over a given window of time and working backward to find company 401(k)s that were invested in them then.

“The plaintiff’s bar is getting very creative in how they approach this,†Blachman said. “They saw some limited success with excessive fees cases, and now they appear to be trying TDFs.â€

Active vs. Passive

A critical difference between the JPMorgan and BlackRock suites of funds is the management strategy investment banks use to choose securities. Success in TDF litigation could hinge on the level of involvement money managers and retirement plan officials have in that process.

The BlackRock LifePath funds are passive index funds that set a glidepath for investments based on a model that’s tied to diversified portfolio performance. The JPMorgan suite is actively managed, meaning Wall Street managers are operationally involved in trying to beat the market, introducing more risk and reward in the process.

Courts have been eager to make clear distinctions between the two investment management strategies. The US Court of Appeals for the Eighth Circuit in 2020 said active funds have “different aims, different risk and different potential rewards†in a ruling reviving a claim against Washington University in St. Louis.

That could mean it’s easier for plaintiffs to survive the motion to dismiss stage if they can clearly demonstrate that riskier active funds underperformed. But it’s still unclear whether courts will permit active funds to be compared to passive ones, or if analyses should remain within the two separate fund categories.

Retirement plan officials held to a strict fiduciary standard of conduct for selecting and monitoring investments aren’t afforded the same nuanced analysis. The US Labor Department has been careful never to give plan fiduciaries a pass on their duty to keep a watchful eye over the entirety of underlying investments in a TDF strategy, said Susan Rees, of counsel at the Wagner Law Group PC and a former DOL division chief.

“I think they’re concerned about abdicating a plan fiduciary’s responsibility to make prudent investment choices,†she said. “Over the course of time within a fund, the investments will change based on a formula, not based on the choice of any fiduciary.â€