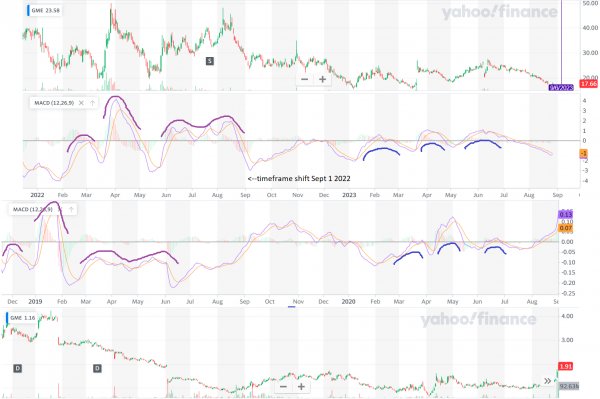

Sept 2022 Margin Requirements and the Wyckoff accumulation phase of 2023

What about it?

Please refer to my post about a change in Initial Margin requirement dates that started Sept 1 2022: https://reddit.com/r/Superstonk/s/RQh5kswiQl

Seems something changed/shifted when this new Sept 1 2022 date when into effect as you can see in the photo.

ABOVE: More recent price action 2022-present

BELOW: Price action 2019-2020.

Regarding this year's price action and lower volume:

"Volume Analysis: Volume plays a crucial role in analyzing the Wyckoff Accumulation pattern. During the accumulation phase, volume tends to decline as the trading range narrows. This decrease in volume indicates diminishing selling pressure and suggests that accumulation is taking place."

Regarding the markets upcoming reduced liquidity because of (my opinion) the requirement to post margin on Sept 1 2023 (larger than usual because some funds were able to defer through the last Jan 1 2023):

"A market's liquidity has a big impact on how volatile the market's prices are. Lower liquidity usually results in a more volatile market and cause prices to change drastically; higher liquidity usually creates a less volatile market in which prices don't fluctuate as drastically."

What happens to a stock with these traits in the above conditions?

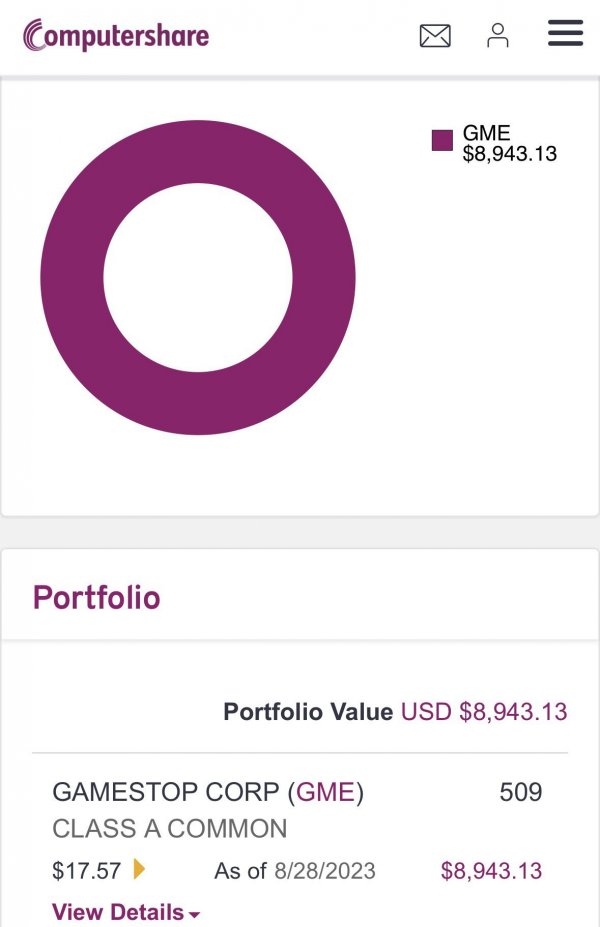

- QoQ / YoY improvements in SG&A, cash flow, etc

- Hundreds of thousands of loyal followers

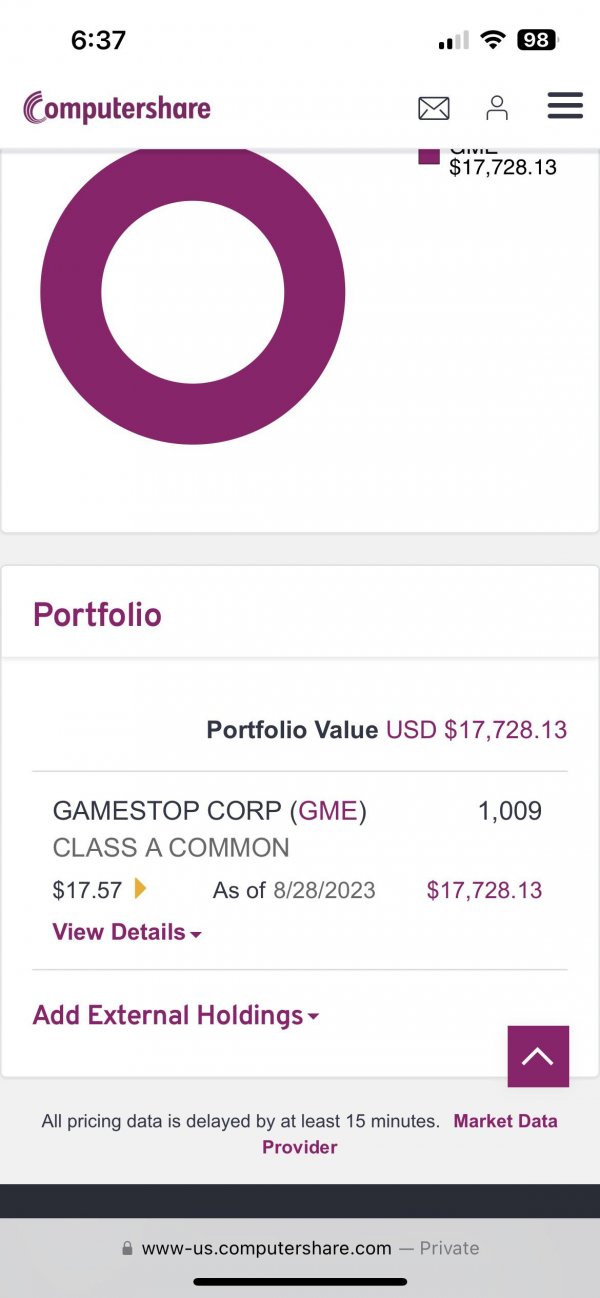

- An ever decreasing float

- Insider buying

- Higher than avg short interest

- etc etc etc